Tax Bracket Philippines 2025. Make the tax system equitable, efficient, and simple 3. This trend is driven by a growing demand for skilled labor and the need to.

Download here the new bir income tax tables under the approved train tax law of the philippines. Several factors are expected to influence wage growth in the philippines.

It is a tax on consumption levied on the sale, barter, exchange or lease of goods or properties and services in the philippines and on importation of goods into the philippines.

Tax Bracket Philippines 2025 Desiri Beitris, Employees deriving purely compensation income from two or more employers, concurrently or successively at any time during the taxable year The median wage increase is projected to rise from 6% in 2025 to 6.2% in 2025, with businesses budgeting for a 5.7% overall wage increase.

Tax Bracket Philippines 2025 Desiri Beitris, It is done by multiplying your taxable income by the applicable tax rate and subtracting any tax credits or payments you've made. Make the system buoyant 5.

2025 Tax Brackets Mfj Roch Violet, Download here the new bir income tax tables under the approved train tax law of the philippines. The philippines tax calculator below is for the 2025 tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in philippines.

What Are 2025 Tax Brackets Rahal Carmella, Projected salary and minimum wage increases. For employees and employers of a company here in the philippines, the changes on the new sss contribution has taken effect since january 2025.

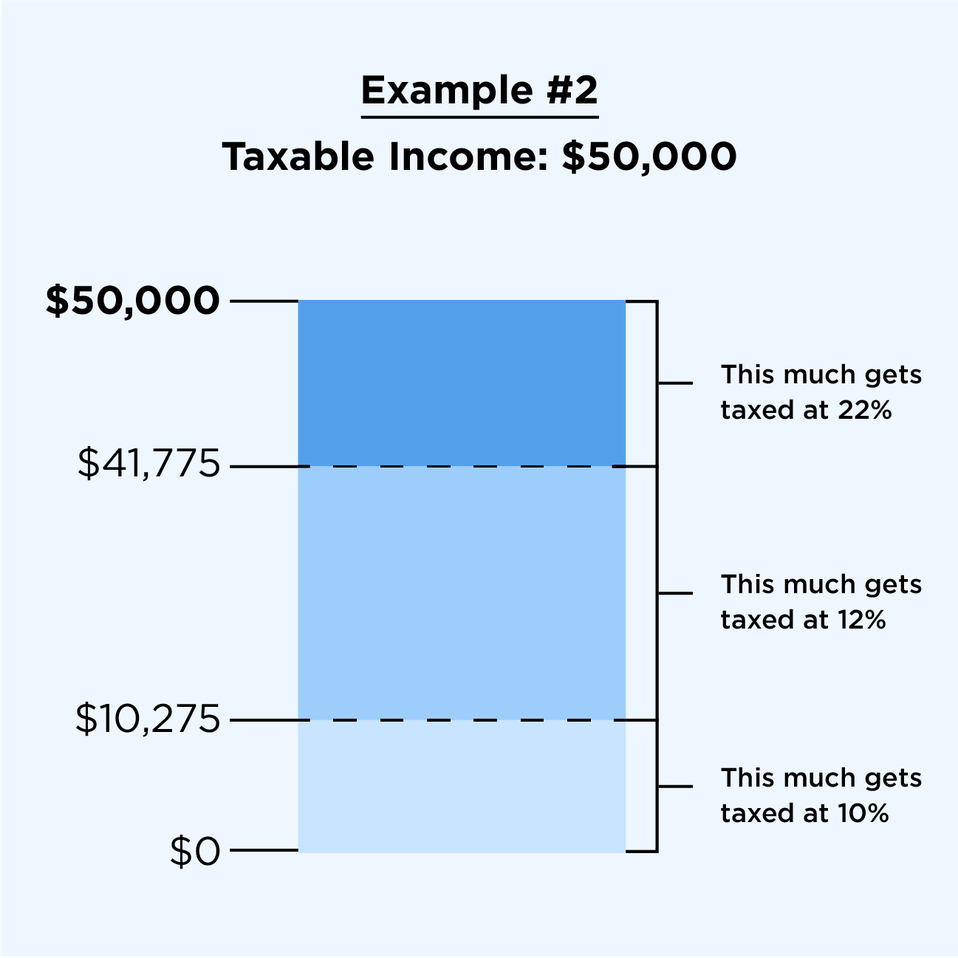

Revised Withholding Tax Table Bureau of Internal Revenue, It is determined by your taxable income and based on the graduated tax rates set by the bureau of internal revenue (bir). It is done by multiplying your taxable income by the applicable tax rate and subtracting any tax credits or payments you've made.

2025 tax brackets IRS inflation adjustments to boost paychecks, lower, Taxpayers will have more benefits and advantages using the new tax rates and schedule for the year 2025 and onwards. Understand key policies, meet deadlines, and employ strategies to ensure compliance and minimize tax headaches

The Ultimate Guide to Canadian Tax Brackets 2025, Graduated income tax rates for january 1, 2025 and onwards: Income tax withheld constitutes the full and final payment of the income tax due from the payee on the particular income subjected to final withholding tax.

Tax Bracket Philippines 2025 Dory Nanice, If you make ₱ 20,000 a year living in philippines, you will be taxed ₱ 2,756. Whether you’re an individual or a freelancer, these updates can make a real difference in how much you pay in taxes.

New Tax Brackets 2025 See How You're Affected for Social Security, The median wage increase is projected to rise from 6% in 2025 to 6.2% in 2025, with businesses budgeting for a 5.7% overall wage increase. Resident citizens receiving income from sources within or outside the philippines.

20222023 Tax Brackets and Federal Tax Rates NerdWallet, Whether you’re an individual or a freelancer, these updates can make a real difference in how much you pay in taxes. The eopt act has unified the tax base for vat on sale of goods and sale of services and use or lease of property.

It is done by multiplying your taxable income by the applicable tax rate and subtracting any tax credits or payments you’ve made.